The Waiting Is The Hardest Part

Current admin policy is likely to drive a significant slowing not priced into markets. While calling the top may feel good, it's much better to wait for multiple signals to align. We aren't there yet.

Positioning is tough with such ambiguity about the magnitude & duration of negative growth policies and how and when it will flow to the real economy. In such times it's better to look for short-term signal alignment than front-run medium-term likely outcomes.

There is no doubt that the admin is pursuing what is on net negative growth policies over the next 6-12m. Immigration is collapsing, cutting >1.5% off of labor force growth vs. ‘24.

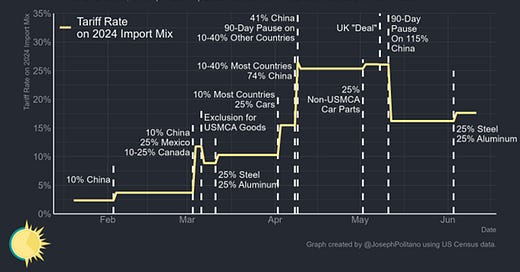

And at 15-20% effective tariff rates, the US economy is facing a near immediate 2% of GDP tax hike which has to be absorbed by either businesses (particularly the wholesalers) or households as they pay higher prices.

On a forward looking basis these policies far outweigh any benefits from the spending bill, certainly in the short-term. And this likely understates the immigration drag impact.

And of course the risk of TACO suggests that many of these negative growth policies could be quickly reversed, giving hope that whatever impact will not have long lasting impacts on the real economy even if right now the admin has every intention of following through.

While it's easy in these sorts of environments to get hopped up on expectations of weakness ahead, particularly at record high equity valuations and LT bond yields, such uncertainty requires the discipline to see confirmations of this path ahead before taking on risk.

And right now we just aren’t seeing confirmation. The most telling is that the timeliest indications of growth are really not yet slowing down.

If the negative growth policies *currently* in place aren't creating a slowdown yet, its unlikely assets will recognize it too. There typically has to be some kind of “growth scare” before investors so trained on BTFD contemplate a different path.

Further this set of policies has never been tested at this scale, which should give pause in our confidence that its going to work as we expect. It's possible the income-driven expansion may be able to handle these shocks and keep on trucking.

While that’s not my baseline expectation having studied these sorts of dynamics in depth, there is also likely little cost to wait and see how the policies shake out before building positioning, particularly if there are obvious lags on the flow through to the real economy.

We are also not seeing indication of concerns in the market action needed to engender shifts by the long-only, levered, or systematic folks. Without any market confirmation, positioning to the downside is a waiting game looking for an incentive to move lower.

Waiting is one of the hardest things to do in macro trading, particularly when you think there is likely to be a negative shock ahead. But without some confirmation across economic data or markets, these types of views are more low-ratio speculation than bets worth going all in on.

The cost of waiting is that you wont be able to say you called a top or bottom tick. But that’s just pride. Generating alpha reliably over time means focusing on high ratio opportunities. Right now, that's just not where we are. So for now we wait and see for confirmation.

Totally agree, feels more like a few market regimes are clashing atm. Thanks E