Don't Fire Until You See The Whites of Their Eyes

Despite the many reasons to pessimistic about the economy ahead, real time data suggests it's holding in there. Equity shorts should heed caution in this type of environment.

There are lots of reasons to feel bearish on the real economy ahead, but the timeliest hard-data reads on the US economy show only very modest slowing in recent months. Claims, withholding, rail traffic and temp staffing all point to a touch of weakness through May, but far from the economic impact from an acute slowing.

There are a bunch of publicly available timely growth indicators, but many have challenges. The Atlanta Fed measure getting a lot of attention is focused on tracking *measured* GDP which is not necessarily a good indication of underlying growth in any quarter.

High frequency hard data is often more useful in getting a read. The Fed’s weekly economic index summarizes 10 different timely hard data indicators on a weekly basis. The latest reads are a touch weaker, but hardly noticeable on this 5yr chart.

If you squint you may be able to see the most recent figures on the lower end of the recent range, but hardly concerning.

Under the hood we see largely the same picture in the raw data series that go into the above. Redbook is holding in there just fine.

Initial claims are a tad elevated relative to last year, but no obvious recent deterioration.

If you look closely, continuing claims are weakening just a touch more rapidly than through most of last year.

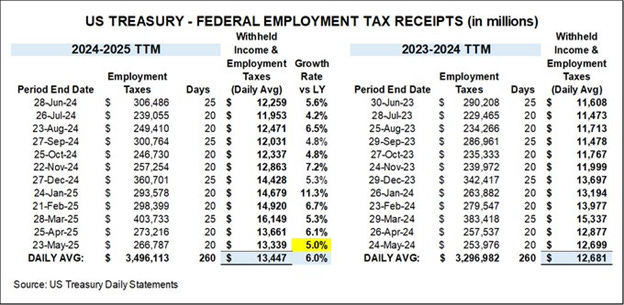

Income withholding looks like it might be slowing just a tad down to 5% nominal from closer to 6% over the last year.

As an aside, its notable that the withholding is a pretty good read on overall wage growth through time, so definitely something to keep an eye on.

Weekly rail traffic has slowed a touch in recent weeks.

Temp staffing remains soft, and a touch below last year’s level. But there are no signs of any rapid weakening.

Gasoline demand remains in the ballpark of what we saw a year ago. Maybe you could say it was a touch soft in April and then again here in May.

Steel production is one of the bright spots, though this may be more idiosyncratic given the tariff dynamics.

Electricity consumption has also surged, but such an outlier is more likely related to weather than any unique economic activity dynamic.

If the economy was rapidly weakening it’d show up in the timely hard data. But it's not. While some are wiggling a bit strong and others weaker, nothing looks like all that unusual at this point. While the tariff + immigration impact may come, it’s not moving the needle yet.

Without confirmation of policy drags in the hard data, it is going to be tough for equity investors to start questioning current pricing. It suggests that even those with a bearish outlook here are better off sitting tight until they see the whites of the slowdown's eyes.