High Tariffs Become Reality

The 15-20% tariff currently in place is translating into an abrupt ~2% of GDP tax hike on the US economy. While it can be absorbed for a short time, if these tariffs stick, it's far from priced in.

The current 15-20% tariff rate is starting to bite. The ~40bln in May duties under current policies suggests the tariff drag is a 1.7% of GDP tax hike on the US economy. Unless brought down soon (through court action, deals, etc.), it's going to start hitting the economy soon.

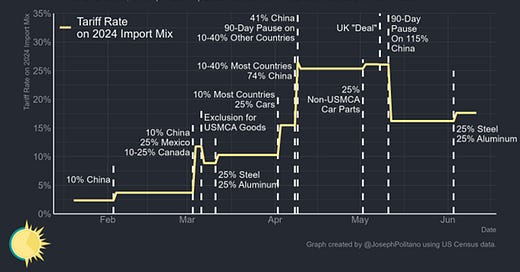

After months of speculation about what duties will be implemented, we are finally starting to fully see the impact of tariff policies in the government cashflows data. Today the blended rate stands at around ~17.5% including the additional duties on steel and aluminum recently announced. The chart below is from

who has been doing great work quantifying the shifts in policies of late. Definitely worth a sub/follow on your platform of choice.And for perspective even at current levels which have come down, the tariff rates are the highest in a century (this doesn’t include recent 2x on steel and aluminum).

The treasury daily statement gives insight into the duties collected in pretty close to real time. With nearly a full month of May in place, we see total collections at almost 40bln or a near 500bln pace. Assuming ‘24 import levels, that implies a ~15% blended rate.

Some of this period is before the China “deal” so the effective posted tariff rate over the period was closer to 20% than today’s 15%. While it'll be a bit before we get the import data, it implies a ~25% reduction, not too far from the US-China direct data printed so far.

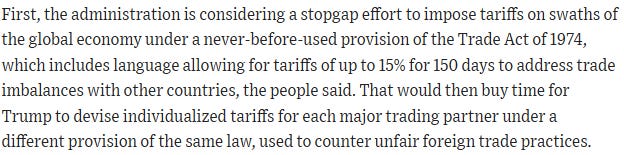

While there is a lot of uncertainty about the path forward on tariffs from a legal perspective, there is pretty clear room for the admin to at least extend this roughly 15% level for 150 days beyond any injunctions while they do the underlying work to keep them in place.

At current levels these tariffs are still likely to create a significant inflationary impulse on the end consumer, which will take a little time to flow through as inventories get drawn down and corporations eventually respond.

The surge in imported good prices at these tariff levels without a commensurate rise in wage income is likely to create a drag on real consumer spending ahead.

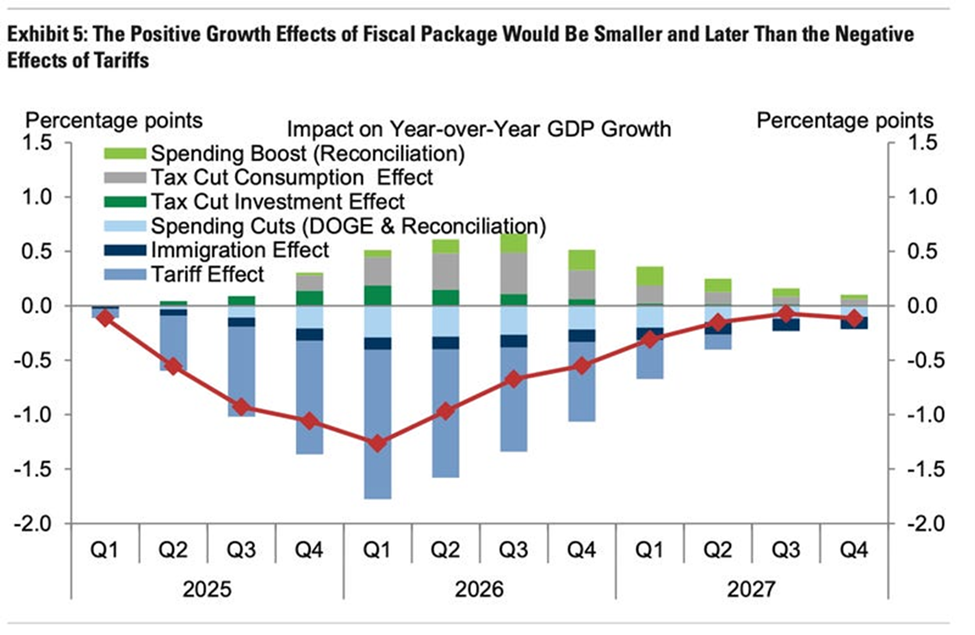

While many are pointing to the stimulative impacts of the big beautiful bill, timing matters, a lot. The impact from the tariffs at these levels will be felt quite quickly in 2H25 while the positive impulse from the bill (assuming its passed in current form) doesn’t hit the real economy until the middle of ‘26.

The US looks increasingly on a path for roughly 15% tariffs over the course of the next couple quarters as legal cases get worked out and the admin extends at that level using Sec 122 if needed. Even though those tariffs are lower than they have been, it still represents the highest rates in 100yrs.

We are only now seeing the initial impacts of these higher duties and over the next 3-6m the outcomes will flow into the rest of the real economy dragging on the HH demand well before benefits from the BBB come in. It looks like a reality not well reflected in market pricing.

Strong take, Bob. At IntelliSell, we’re already seeing the impact of these high tariffs ripple across SME manufacturing—reshoring is accelerating, but so are short-term margin pressures and inventory mismatches. The policy may be long-term strategic, but the pain for mid-market operators is immediate. Appreciate you covering it with nuance.