No Immigration, Weak Growth Ahead

The post-covid surge in immigration provided a 0.8-1% boost in real growth for the US economy. The impact of the admin's policies restricting immigration ahead are not well reflected in asset prices.

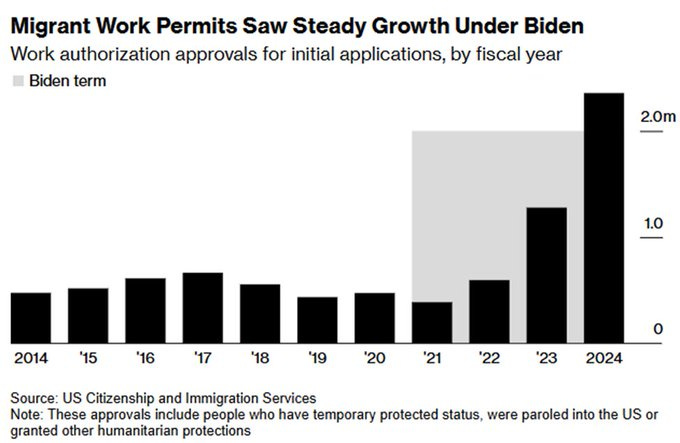

Immigration has collapsed since the new admin took office, and with it a key source of new demand and labor supply bolstering growth in recent years. The '24 surge of 2.4mln work permits (1.4% of the labor force) is now reversing, creating an acute growth drag ahead.

Anytime I talk about such a politically charged policy shift there will inevitably a pile of comments about whether the policy is good or bad. That doesn't matter a lick for macro investing. What matters is simply the mechanics of the impacts of those shifts on the economy.

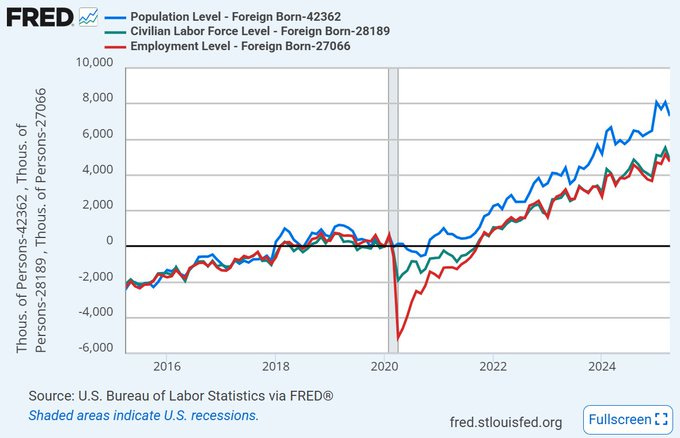

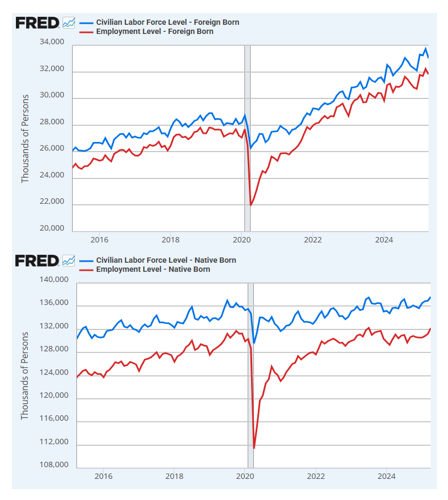

Since COVID for instance, the foreign born population has risen roughly 7.3mln, the workforce 5mln, and the same with employment. Its worth noting that this is based on surveys (not payrolls) so includes some informal/unauthorized work, though likely undercounts it somewhat.

Starting in January the admin essentially stopped all immigration. The southwest land border encounters shows it clearly. The pace of inbound immigration has fallen from a roughly 2.5mln/yr rate at peak to essentially zero.

The impact of such a shift is likely to be pretty stark. Basically all labor force & employment growth in the post covid period is a result of foreign born labor as the native born labor force has stalled out due to demographic issues.

While the above includes informal and formal work arrangement, the impact on formal work has likely been more extreme of late. Work approvals surged under the previous admin to nearly 2.4mln, a surge of nearly 1.4% increase in the formal workforce.

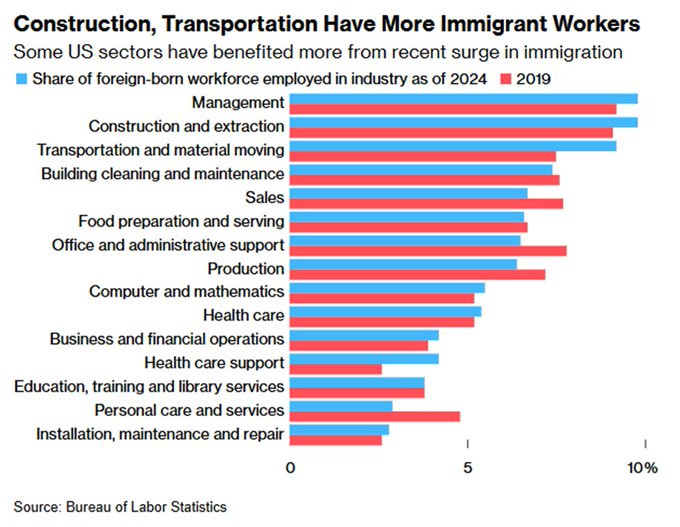

The surge in foreign born work has also been critical in loosening some of the tightest services sectors of the labor market like in health care support, construction, and transportation.

While the slowing of incremental new labor force growth represents a drag, a reduction in the number of foreign-born workers in the US through the revocation of previously issued legal work permits, but so far courts have blocked such efforts.

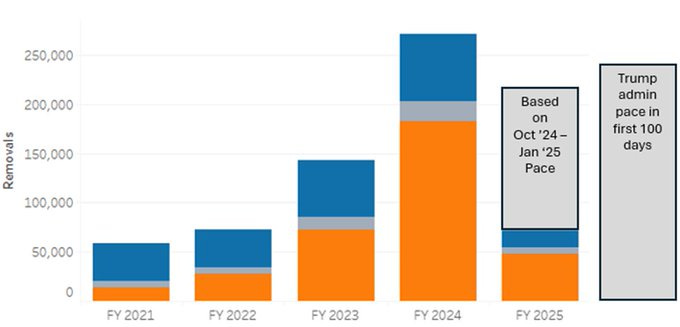

A surge in deportation could also reduce labor supply in the informal sector in particular. The efforts made so far have garnered splashy headlines but look pretty unremarkable with any context (for now).

Foreign born labor has been adding roughly 0.8-1.0% to US real growth during the post-covid period, a significant boost for an economy that has grown at about 2.5% real overall. If anything the surge in formal permits in '24 made it an even bigger support.

The new admin's policies are set to slice this support to roughly zero in the years ahead. While the impacts wont be felt immediately, these efforts represent a significant drag on medium term growth at a time when growth expectations in asset markets remain at all-time highs.