The Fed Will Do Nothing Longer Than Most Expect

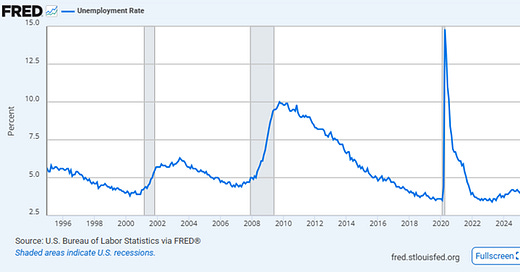

The Fed decides based on the data it sees. With UE low and stable and inflation still elevated, holding policy steady is the right choice. Tariff & ME conflict risks make the choice even clearer.

The Fed has no reason to cut based on the data that matters to its decisions.

The risk of inflationary pressures ahead from both tariffs and rising oil prices due to the Mideast conflict will only further solidify their desire to keep rates steady for longer than most expect.

While many folks are calling for immediate substantial cuts, the data that the Fed cares about just doesn’t support any move at all. Take the UE rate. It’s remained low with any context and been flat for almost a year, suggesting current policy is roughly neutral.

Payroll growth has slowed substantially particularly if you include the likely revisions to the data that will eventually come. But the Fed isn’t in the business of making bets on QCEW revisions quarters from now to make monetary policy today.

And the reported payrolls remain high enough to keep the labor market modestly tight given the big down shift in immigration in recent months. At this point the neutral payroll growth number is well below 100k/m, and reported numbers have beaten that consistently.

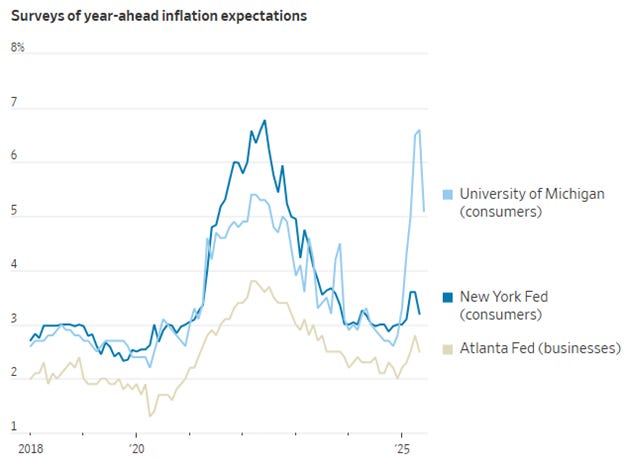

The inflation measures the Fed cares about also remain elevated. Core PCE is at 2.5% y/y, and even with a soft May print, it will likely tick up. Sure the last few months have been soft, but that came after a way too hot quarter to kick off the year.

Most expectations are for the May numbers to actually tick up on a y/y basis in the May report, and there is unlikely to be further relief for June with current expectations of at least 2.6%, representing now 50 months where the measure was above the Fed's mandate.

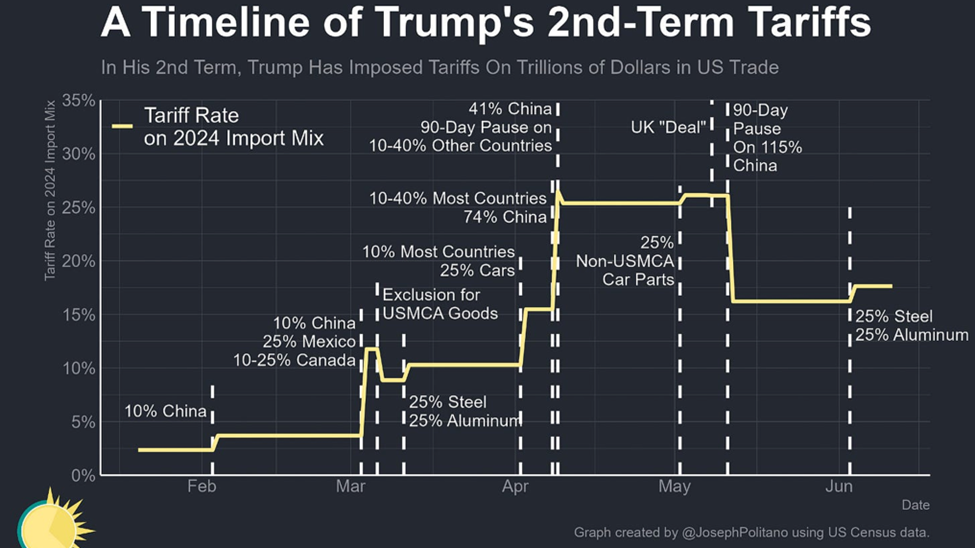

And those data are likely only starting to reflect the impact of tariffs on imported goods which really only surged post liberation day and it’ll take some time to actually impact the reported data.

Rough estimates are that the current level of tariffs if extended would amount to a peak +1% impulse on core PCE inflation relative to the non-tariff baseline which would fall gradually to the Fed’s target by year end. This likelihood further solidifies the Fed’s delay.

While the Mideast conflict is not likely to cause anywhere near the stagflationary oil shock of the past, the moves so far will probably nudge headline inflation up a couple tenths of a percent over the next few months, with the uncertainty band on what's to come even wider.

JP’s biggest concern is that a new inflation shock from either the tariffs or oil price rises will once again seep into the expectations of HH and Biz, creating some risk of entrenchment. In his defense, inflation expectations across a couple sources have risen in recent months.

Underlying all of this is what is a clear need for the Fed to assert its independence from the President. While commentary like this probably wouldn’t cause JP to run policy inconsistent with conditions, it likely steels his resolve to keep the pause in place.

While there is little chance of a cut today, markets continue to expect the Fed to move once again pretty soon. Getting such a move would likely require a pretty material growth weakening along with a pretty clear resolution of the tariffs & geopolitical inflation risk.

As an aside it is also notable that despite lots of rhetoric that the new chair pick by Trump in ‘26 will be one of the biggest doves ever seen, current market pricing is for pretty modest cutting moves, with moves right around the new chair pretty modest.

Judged on the merits of the data & the uncertainties, stable monetary policy will be the right move for the foreseeable future. UE has been stable at a low level for almost a year and inflation remains elevated with upside risks ahead.

As for the asset holders and the federal gov looking for the Fed to bail them out with easier policy ahead, they are likely to be pretty unhappy with the type of conditions required to get the cuts they so desperately seek.

Looks like about half committee is with me already in the no cuts for '25 camp. Suspect the camp will expand as tariff-related inflation pressure flows through and the UE rate remains artificially depressed due to low labor supply.

Completely agree. I believe many are too rooted in recency bias and “r-star” estimates that are based on a different cohort of data (ie pre Covid). None of us know what neutral is and with the balanced risks, the best move is no move.