The Coming Season Of Disappointment

Markets haven't moved much lately despite the noise of daily volatility even as conditions have clearly weakened. With pricing still penciling out a boom ahead, 2H25 is shaping up for disappointment.

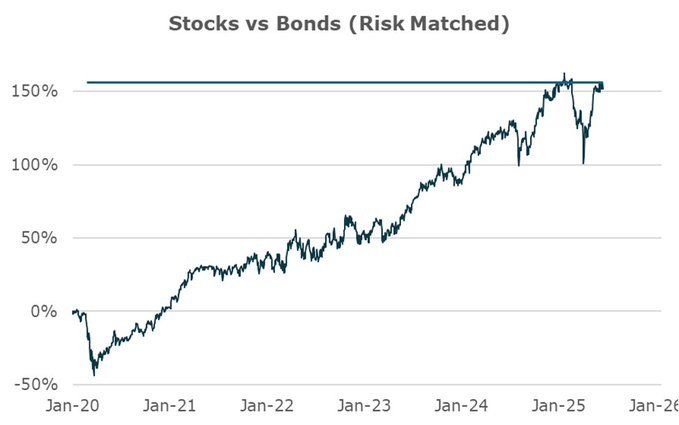

While there has been a lot of daily volatility, not much has changed in asset pricing over the last month. Stocks vs. bonds, gold, DXY, and US vs. ROW stocks are all about flat even as economic stats in the US have weakened. It's a divergence likely to close ahead.

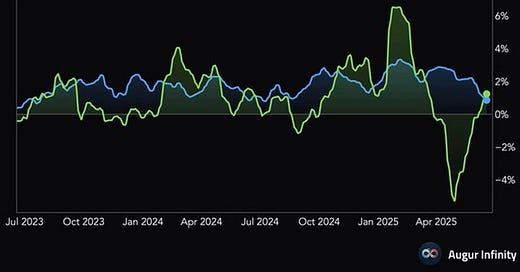

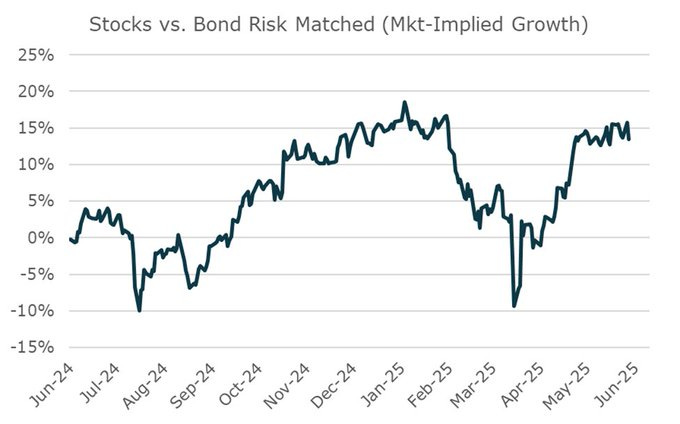

Market implied measures of growth have been pretty stable just off cyclical highs over the last month, here represented by stock performance relative to long-term bonds.

Expectations for Fed monetary policy here measured by 2yr bonds haven't really budged.

Gold has been pretty stable in recent weeks.

The dollar has only very slightly weakened, though that has reversed a bit in the last couple days.

And international stocks have basically been flat relative to US stocks over the same timeframe.

This all comes at a time when there are increasing signs of weakening economic conditions. While the soft data has improved a bit in recent weeks, it's pretty clear that the hard data is decelerating swiftly across a range of sectors in the economy.

And those stats are now significantly disappointing analyst expectations, here shown through the Bloomberg surprises index abruptly reaching lows of the year.

This weakening in stats so far primarily reflects the ongoing softening of the income-driven expansion, but not really of the policy drags from the new admin.

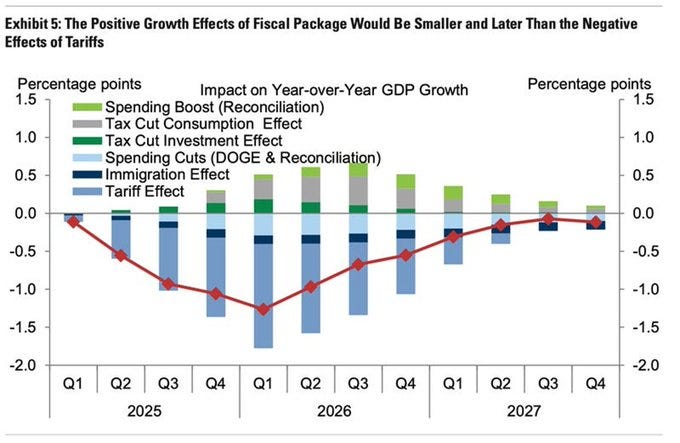

The impact of these growth negative government policies - like tariffs and immigration - are more likely ahead rather than behind us. And they are likely to far outweigh the positive impact of the BBB in a timeframe markets care about.

Despite this recent set of deteriorating economic conditions and the poor outlook ahead, markets are back to pricing in the highest expected growth rates of the cycle. Stocks vs. bonds are once again at cyclical highs.

And that is being driven by a combination of long-term bond yields at near all time highs and equities near all time highs as well.

Doing nothing has been a good trade since I took off risk a month ago as “The Waiting Is The Hardest Part” has been the overwhelming macro theme. But a turn in economic conditions is now starting to become clearer.

The combination of high expectations, softening growth, and a Fed on hold is a classic setup that favors bonds and gold relative to stocks.

While it may take a little while for markets to acknowledge the reality it looks like 2H25 is shaping up to be a season of disappointment.