Fading Household Demand Threatens US Growth

Labor market softening looks to be flowing through to a deceleration in household demand in recent months. Stock and bond markets are far from pricing in this decay of the income-driven expansion.

There are increasing timely signs that US consumer spending is starting to decelerate. Given the critical role of HH consumption powering US growth, that suggests a broader slowdown of the income-driven expansion may be on the horizon.

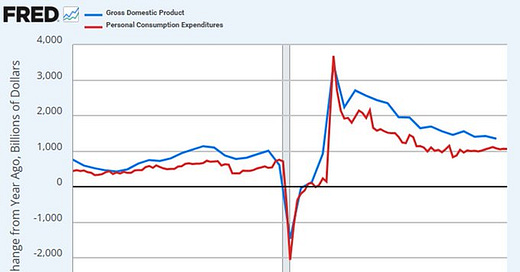

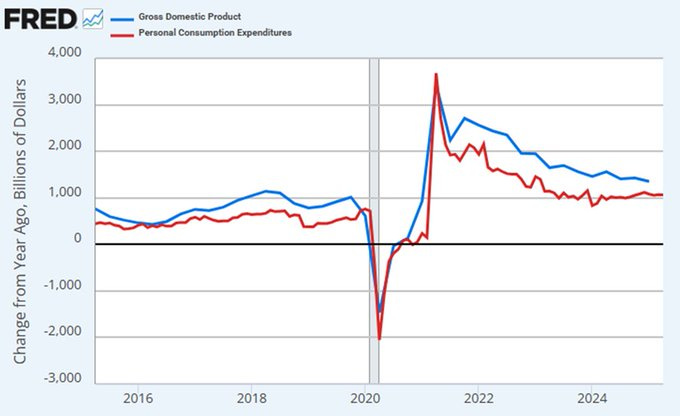

Folks who have been reading for awhile know that HH spending growth powered by HH income growth has been the primary driver of the expansion in recent years. As the chart shows, basically all the shifts in GDP growth in recent years have been driven by household spending.

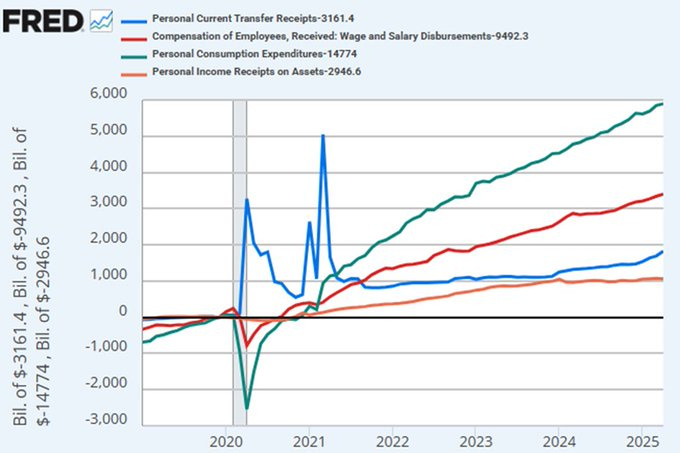

A surge in government transfers lifted spending out of covid, but from mid ‘21 wages have financed rising consumption. Interest income has been flat for years & the recent transfers uptick is a one-off catchup related to the Social Security Fairness Act which not grow further.

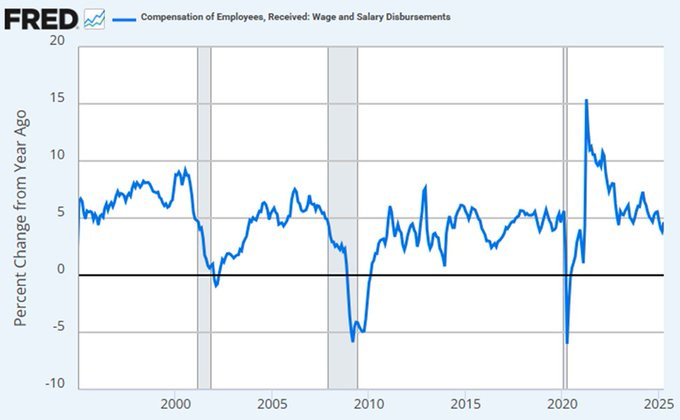

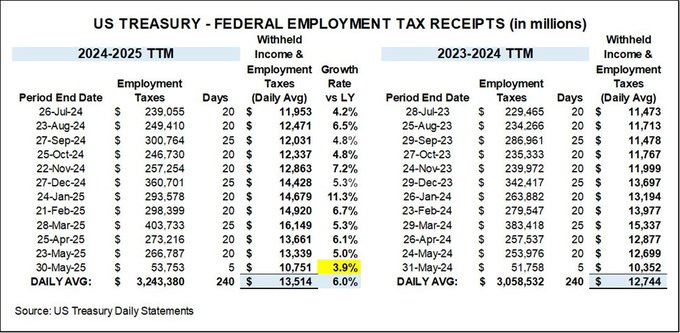

The softening labor market now puts this income-financed expansion in jeopardy with both hiring slowing and wage growth coming down considerably. Total cash compensation growth for household has slowed to its softest pace in the cycle and is set to slow further.

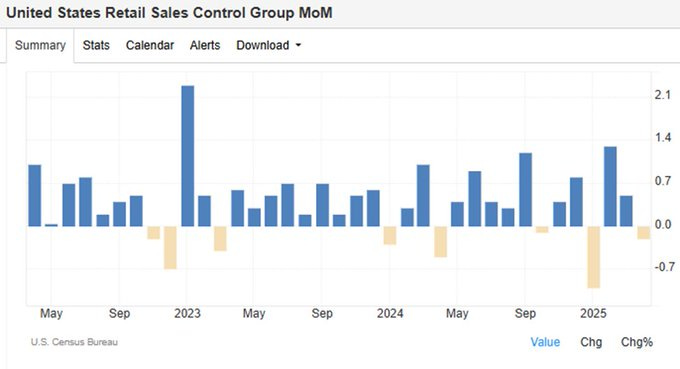

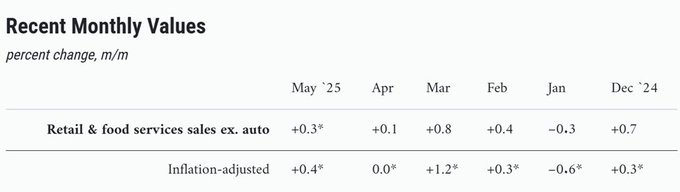

Given that its no surprise we are starting to see some signs of softness in HH consumption growth. Ahead of the report coming today, the nominal retail sales control group had only risen 0.6% in the first 4 months of the year - a truly anemic 1.8% nominal growth rate.

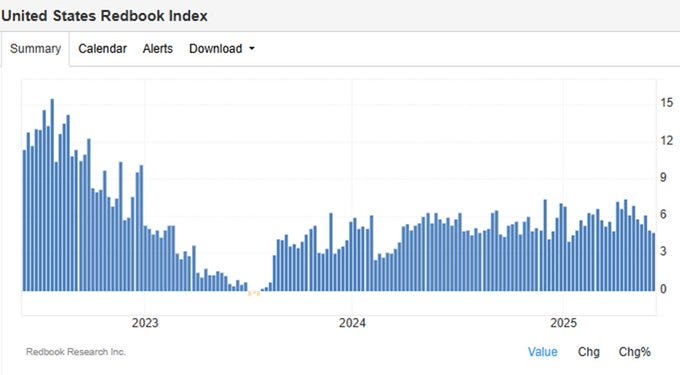

And there are signs of slowing since. The Redbook survey which had been an important timely indicator of continued strength in the HH sector has faded to its lower run rate in almost 2 years in recent weeks (and this is a y/y series so the downward momentum is notable).

Some timely card spending data confirms that deceleration. The Bank of America transactions figures suggest a rapid deceleration through May to some of the weakest spending in months.

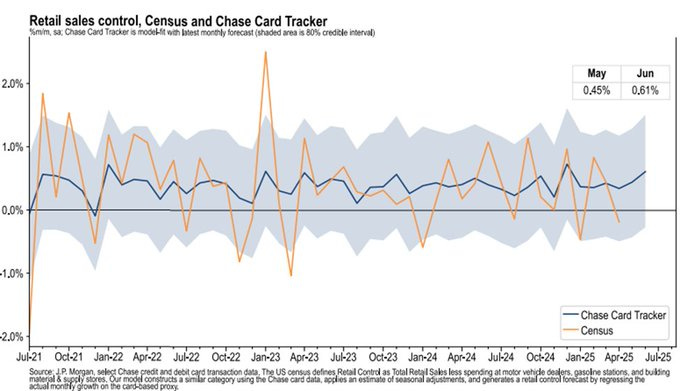

But the timely spending data is not totally consistent across sources. JPM data (which isn't nearly as volatile as reported retail sales) suggests basically flat spending in May & into June.

And Chicago Fed CARTS read on spending which aggregates a number of different data sources (like foot traffic and transactions) suggests an ok read for the print this month, but it has been way off recently (said -0.6% for Apr vs. +0.1% reported).

For years the income-driven expansion powered household consumption and with it the US expansion. That appears to be fading, with the timeliest income data suggesting further slowing through May. In line with many other timely employment indicators showing weakness.

While all eyes are on various geopolitical conflicts, the underpinnings of the US expansion are quietly decaying right before our eyes. With equity prices and yields still near cyclical highs, the markets are hardly reflecting the consequences of this emerging weakness.

Spending is one thing and I understand our economy relies on it. Having too much debt and too little savings is another. I'm still anticipating more downside to come. Thanks Bob for sharing your thoughts.