The Tariff-Driven Inflation Rise Is Here

Scanning across a range of measures shows a clear pickup in price growth in recent months, while markets show little concern. If tariffs stick around, growth will disappoint current expectations.

There are broad signs inflation is picking up across the economy. Markets remain complacent despite surveys and timely price measures showing signs of increasing price growth. Unless tariffs reverse soon, higher inflation will quickly become a reality, dragging down growth in the process.

Today's measured inflation figures is the first to reflect the real impact of the tariffs (given the previous survey happened just after Liberation Day). Most economists are expecting a pickup in the CPI numbers for the first time in awhile, with core approaching 3% y/y again.

But measured inflation is just one view of many on how price growth is going in the economy. A broad set of triangulation shows price growth rising. Take ISM services prices which is clearly rising in recent months:

Or ISM manufacturing prices paid which has been elevated for months:

The latest NFIB actual prices survey shows the same thing. A clear rebound higher in recent months. Notable since small biz absorbs tariffs more so than larger ones.

Timely measures of prices show the same dynamic. Alberto Cavallo’s work measuring timely Amazon prices shows products made in China starting to rise again, even after the "deal" in early may.

Measures from Truflation also showed an uptick from earlier in the year. Worth noting that the numbers are typically overstated too high or too low given the methodology, so the trend is more instructive than the level.

And we are even starting to some of the impacts in reported inflation too, like in audio equipment.

Many folks point to lower oil prices as a source of disinflation in the economy, but the reality is gasoline prices have remained flat, providing little relief to offset the rising input costs from tariffs.

The rising price pressures we are seeing are likely just the beginning of the flow through into the real economy as it take time for biz to change their menu prices. At current tariff levels, we'd expect to see measured inflation rise over the next couple quarters.

Expectations of future inflation are all over the map at this point. While Umich has surged to silly levels (due to political biases) the Fed survey remains pretty contained and ticked down in the last month oddly enough.

What is clear is that markets are starting to see the impacts of the tariffs, but only in the short term. 1yr inflation swaps are at their highs of the last couple years.

That said, longer-term expectations remain quite contained, with 10yr BEI not budging much, suggesting markets believe any tariff inflation will be transitory in nature.

There are broad signs of inflation pressures as tariffs remain in place, with today's report one of the first looks into how measured inflation will be impacted. Such a rise in printed inflation will continue to make it difficult for the Fed to deliver the cuts priced in:

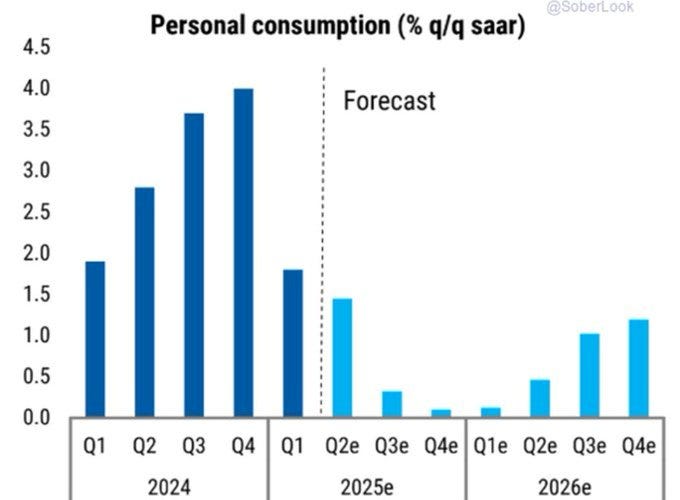

But more important is that higher inflation at a time when labor markets are softening and wage growth is weakening will erode the HH purchasing power so critical to the income-driven expansion. Without a reversal, HH demand is set to slow, a dynamic far from priced in.

Strong thread. This triangulation across ISM, NFIB, real-time price trackers (like Cavallo/Truflation), and CPI is a compelling case that inflationary pressure is building under the surface—even as headline measures lag. Well done.

Bring back the morning walk/chat videos; they're great!