Muted Initial Market Reaction To US Strike on Iran

While markets are pretty sanguine about the impact of the US strikes on Iran, its a another good reminder that most investors are totally unprepared for war if this conflict escalates.

The initial market response to the US strikes on Iran haven been relatively muted, other than the modest push higher on oil. As of ~6am ET US stocks are down about 1%, gold is up 1%, and crude is up a little over 6% to about 80 bucks.

Gold only modestly rose after announcement of the strikes and bitcoin has modestly sold off, but not even broken lows from earlier this weekend. All these moves are small in comparison to the vol typical in these markets.

Equity markets in the region were mostly pushing higher today, with the Israeli market marking all time highs.

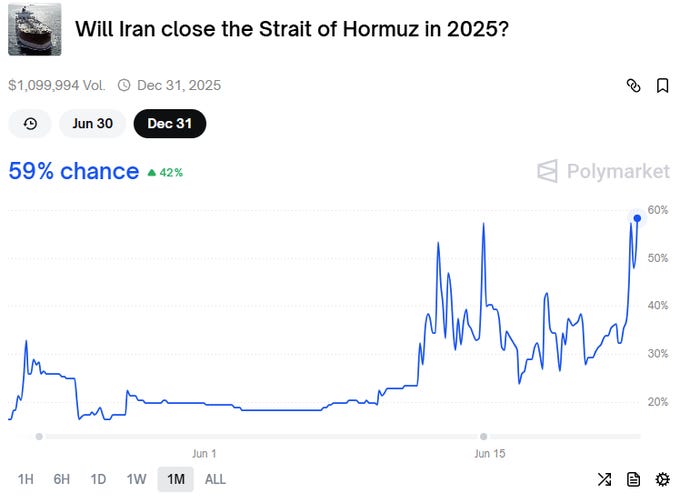

The biggest concerns are of course in the oil market where the main leverage point the Iranians have is closing the gulf which risks cutting off almost 1/3 of total global oil supply. The risk of that happening did surge since the strike, though "close" is ambiguous here.

With crude only up 6%, market pricing is much more sanguine on either the probability of a disruption at least at this point.

Market moves in this range are unlikely to have a significant economic impact, particularly for the US. While oil up 30% in recent weeks sounds scary, its back to the range of the last couple years. Hardly a shock or close to '22.

While the response from Iran remains unknown, markets are pretty sanguine about the broader macro impact of the escalation in conflict. But it is a good reminder that most investors totally unprepared for war if there is escalation ahead.

Give it time

Bitcoin dumping a bit