The UK's Income-Driven Expansion Is At A Turning Point

The UK expansion lasted far longer than most expected, but rapidly weakening labor markets are undermining continued growth. Monetary policy expectations are too sanguine about cuts needed ahead.

The UK economy looks to be at a turning point as their income-driven expansion fades. After holding up for much longer than most expected, rapidly weakening labor markets are set to undermine continued decent growth with short-end pricing under discounting cuts needed.

Data released over the last few weeks highlights the pace of weakening across the UK economy, with the capstone of the timely data released in the last couple days. As an example, GDP sharply weakened in April, contracting for the first time in awhile.

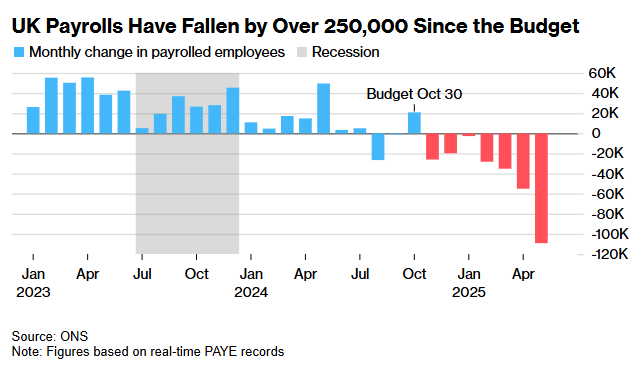

That weakness more than likely continued into May. Payrolls, which had been weak since last fall sharply decelerated through May, notably coming just after the big tax hike on biz in April.

Its not too surprising that the job market is finally weakening given businesses have shown signs of declining optimism since last summer.

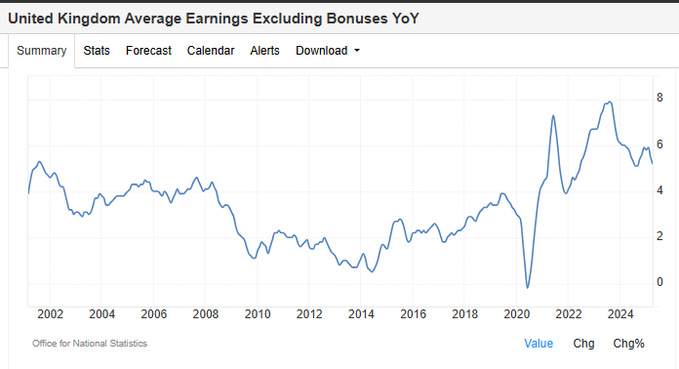

For several years the UK economy has held in there quite a bit better than many expected as decent nominal wage gains allowed household to keep up their spending, but that is showing signs of decelerating, and rising at a mere 3% annualized over the last 6 months.

With such a rapidly softening labor market its going to be tough to slow the deceleration of wage growth. After staying down for awhile, the UK unemployment rate is clearly moving higher, hurting job hunters ability to extract wage concessions.

Despite these rapidly deteriorating conditions, little easing ahead is priced in at this point, with UK 2s trading just under the current policy rate even with the roughly 2 cuts priced in through year end. Given the weakening momentum it is unlikely the cuts stop there.

And its unlikely that there is going to be much relief from fiscal policy. While there are expectations of unwinding some of the past planned cuts, this adds up to at most a tenth or two of lift to growth at the most. Far from what is needed to address the employment weakness.

The only thing holding up more aggressive easing is that inflation remains somewhat elevated, particularly following the recent lift in the energy price cap. Likely something the BoE can look through and focus on the previous decelerating trend given broader economic weakness.

The BoE faces a challenging circumstance where the underlying economic momentum of the income-driven expansion is clearly slowing but inflation remains a bit too high for comfort. How that nets out next week remains to be seen, but there does appear to be a dovish skew.

Current short rate markets are pricing in something close to 2 cuts and done by the end of the year. But the economy appears to be weakening rapidly and current rates remain well above inflation - a combination that will likely require considerably more easing than priced in.