Shutdown Risks Turning Into Real Drag

Normally shutdowns don't really matter, but as it drags on for longer the hit from paused wages and reduced staffing is ramping up, creating risk markets are underpricing the impacts ahead.

Government shutdowns are usually macroeconomic non-events because of the simple reason that they are 1) short lived and 2) the gap in income & spending gets paid back once the government opens. The result is a relatively limited impact outside of a wiggle in month-to-month spending.

This shutdown has now gone on longer than any in the past, increasingly challenging the assumptions that it is something to look through rather than something that will have longer-term macro impacts.

Like any blip in income (hurricanes, fires, earthquakes, etc.), folks involved can smooth their consumption even as income takes a hit. But as folks increasingly fail to receive government payments their behaviors will no doubt start to shift to cutting back.

Further as the government shutdown lasts longer it is likely to have increasing second order impacts on the real economy. It’s one thing to have to skip that visit to Yosemite, and it’s a whole other to see an abrupt 10% cut in aviation - a sector that arguably represents 3-5% of the economy directly and indirectly - and possibly more ahead.

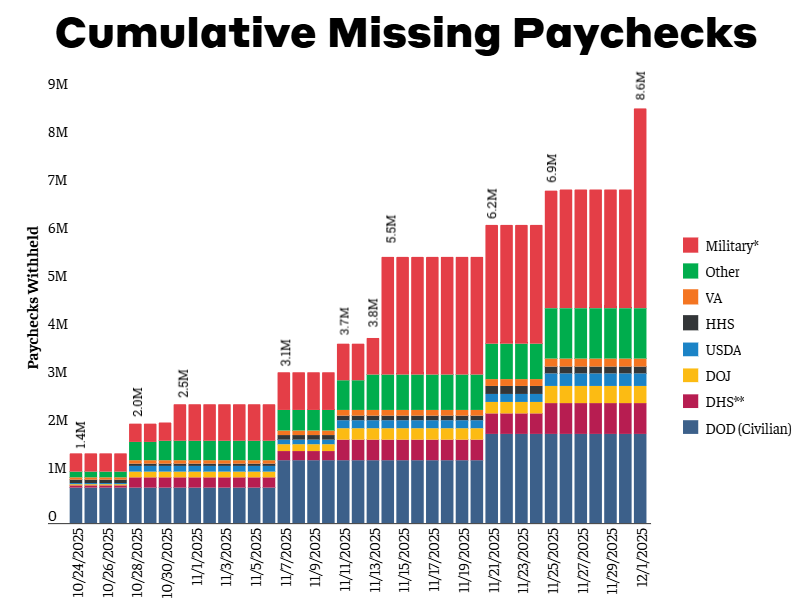

While the government has been able to stave off the worst of the impacts so far (military has been paid, SNAP paid at least in part), such short-term efforts likely can’t withstand a shutdown dragging on longer than the end of this month. Further the risk of the government using the shutdown as a broad cost-cutting effort has been blocked by the courts.

But if it’s December and still shut down impacts will likely become increasingly substantial. The question becomes then how many individuals and companies will start to really pull back, getting ready for a long-haul.

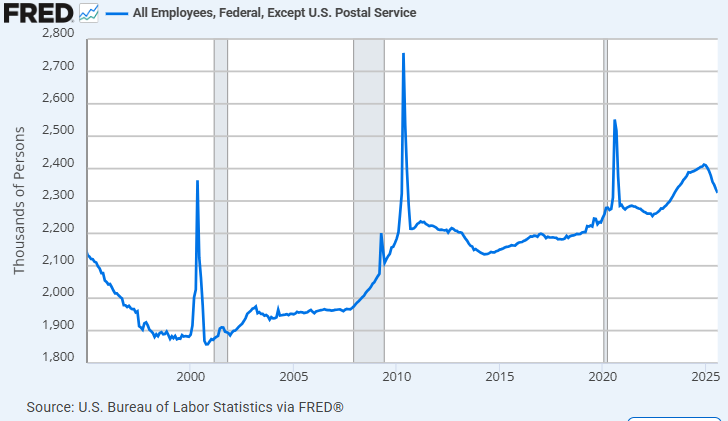

A Look At The Numbers

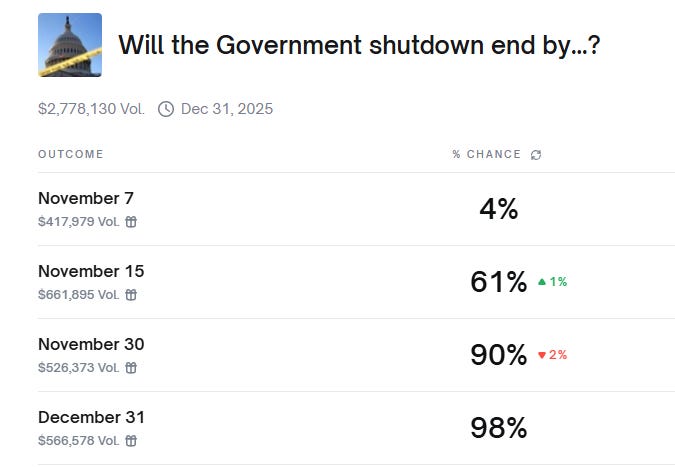

Markets are largely hopeful the shutdown will end shortly, with 90% probability of an end by the end of November. This suggests skewed outcome to the downside if the shutdown remains in place longer than expected.

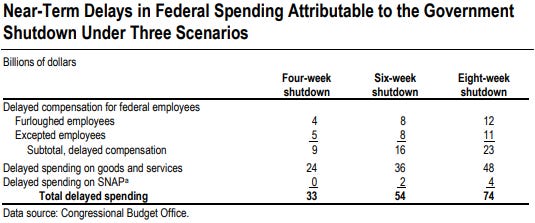

The direct economic impact of the shutdown is relatively well known. The combination of furloughed employees and reduced government spending on goods and services slices roughly 10bln/week in total spending. This hasn’t fully flowed through yet because SNAP benefits are getting paid and the ~1mln military workforce received their 2 paychecks in Oct.

Measuring the economic impact is a little tricky because you have to think through the first and second order consequences of the government spending. There is also a temporary point which is that if the shutdown lasts 1 day there is likely no impact but after a few months the impact is likely to be multiplied as folks who were employed by the government pull back on their spending.

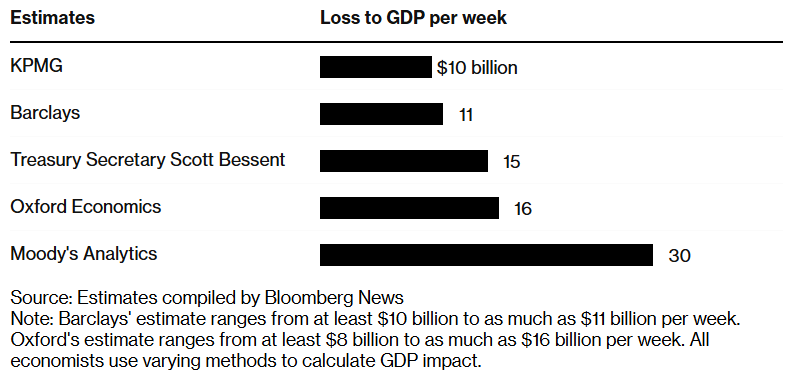

Various folks estimate a range of likely impacts. My guess is its a little lower than the 10bln in the first month and then becomes likely higher than 10bln as it goes on for a few months. That works out to a roughly 10bps cut to measured GDP per week if the shutdown goes on.

The impact of the cuts ramps up over time, not only because certain cohorts like active military have initially gotten paid (though not reserve duty folks) but also because as individuals miss more and more paychecks they are likely to start to shift their spending behavior. Further there is some risk that the government chooses not to pay back these lost wages upon resolution.

The biggest risk of the shutdown was that the administration was going to use it to institute employee cuts in previously appropriated spending that didn’t align their priorities. After announcing the initial reductions-in-force, the courts largely blocked these efforts.

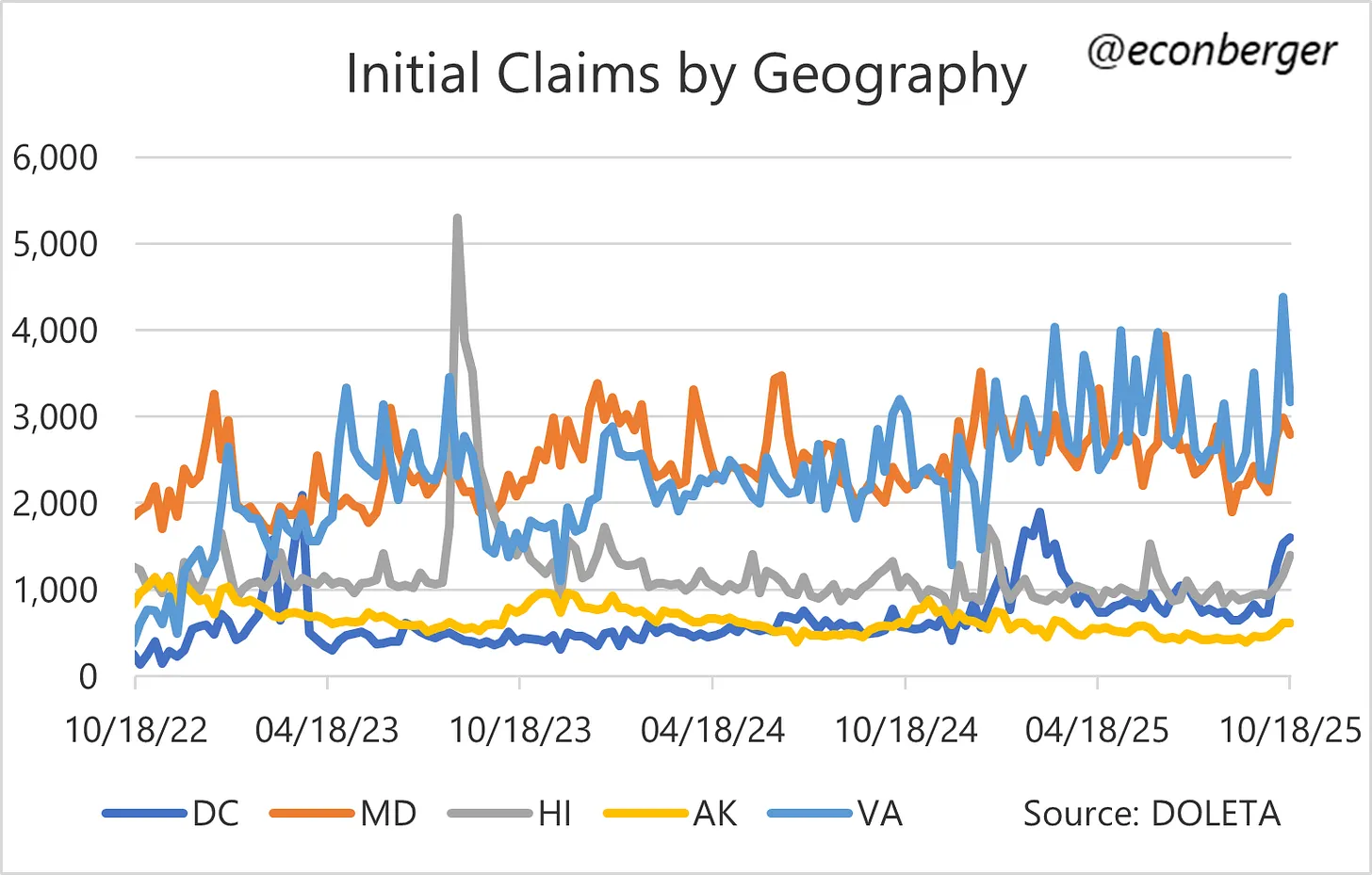

Beyond the government itself there is the risk of layoffs from the large supplier and contractor base connected with the government. As Guy Berger pointed out (sign up for his substack!), we have seen a bit of an uptick in initial claims around high government spending geographies, but none of these is large enough to move the needle.

The bigger risk likely comes from sand getting thrown in the gears of private sector activities with the government cutting back its spending. The most obvious is the recent announcement to cut 10% of air traffic in the US which on its own could slice 5-10bps off GDP as it plays out, which is not likely to recover.

The drag is increasingly felt in areas like finance where registration statements are not going effective, anti-trust and other M&A activities will not be reviewed, and various securities listings will be curtailed. None of these are big enough to create a huge economic impact, but create friction and a backlog that will eventually need to be resolved.

Bottom Line

The government shutdown is transitioning from being a transitory matter to one that is starting to have economic impact on the real economy. Given reduced payments and regulatory frictions, the impact will likely be multiplied beyond just the 10bln/ week or so of reduced income & payments if it continues past month end.

Markets are largely expecting the shutdown to get resolved quickly and have no lasting impacts, which is probably a reasonable base case. But it does create a skewed downside risk if the political fight lasts far longer than most expect.